By Keith Sampson, Senior Vice President, Energy Services

In these early days of 2023, Competitive Energy Services’ Keith Sampson, Senior Vice President, Energy Services shares his viewpoint in a CES interview on energy market trends – with a specific focus on trends for our New England area clients - and offers advice to businesses who have their eye on the near- and long-term commodity strategies for the next winter season.

Sitting here on the cusp of a new year, what has your attention and what matters to folks who are reading your article today?

Inflation, supply chain, the impact of reduced natural gas and oil flowing from Russia, and natural gas inventory levels, are important issues for consumers across the U.S. End users in New England have been particularly hard hit due to a unique reliance on Liquified natural gas (LNG) during peak winter months.

How do you see the 2023 energy market trending? Will this market come down? Even out? Continue to trend upward?

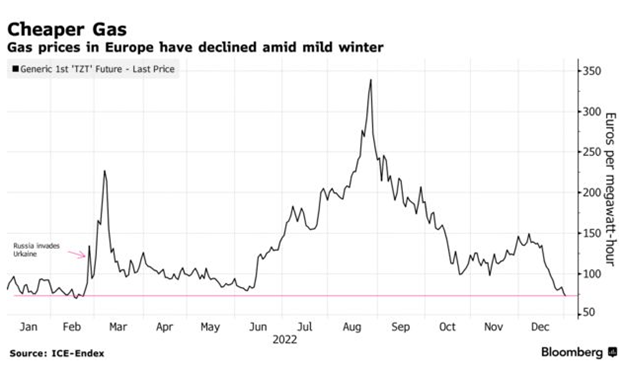

Recently, we have seen energy markets become less irrational. The market is not panicking, and prices have dropped from the summer highs. The Dutch Title Transfer Facility (Dutch TTF), a virtual trading hub for gas in the Netherlands and the primary natural gas pricing hub for the European gas market, tells an important story. Those forward price curves for natural gas do not decline until 2024. This says the world price of LNG will remain above pre-Russian invasion levels through 2024 but should begin to decline as supply increases in 2025 and beyond. Of course, as Murphy’s Law would have it, then the pressure is on domestic natural gas inventories, as the U.S. adds another 25% more LNG export capacity.

Is our current market situation the new normal?

Volatility – yes. Prices that are well above the 2020 decade low, yes. Record high prices seen this summer, no (that bubble has already burst).

Will there be any shortages of fuel this winter?

We have already seen rolling blackouts this winter in parts of the U.S. electric grid including mid-Atlantic and southeast states when very cold temperatures forced certain generators offline. In New England there was a lot of concern about shortages heading into the winter, but I do not think we will have a significant shortage. As it specifically relates to oil (home heating oil and diesel fuel), New England receives the majority of its fuel via ship from the Irving Oil Refinery in Halifax, Nova Scotia to the tune of two-to-four ships per week, delivering to New England ports including Chelsea, MA and Portland ME. Oil is transferred into tanks and then loaded onto trucks. Simply put, that is the supply chain. Barring nothing catastrophic, Irving is going to continue to refine oil; ships are going to continue to deliver that oil; and truckers are going to continue to transport that oil. According to my sources, we have enough ships, we have enough trucks, and we have enough truck drivers.

As it relates to natural gas, ISO New England (ISO-NE) and the energy industry knows there is a fundamental shortage of interstate natural gas pipelines to bring affordable natural gas into the New England region for electricity generation and space heating on peak winter days. However, ISO-NE has a plan to supplement pipeline natural gas that is otherwise diverted to heating needs with renewables, LNG, and oil. Barring no catastrophic event, ISO-NE has a plan to keep the lights on and keep everyone’s home and business warm this winter.

What will happen with the spot price?

To explain spot price, it is important to separate winter and non-winter. In the non-winter seasons, New England has sufficient renewables and interstate pipeline gas to meet demand. Therefore, the cost of basis is negligible, and the cost of spot gas, and electricity are driven by the New York Mercantile Exchange (NYMEX) price, also known as the Henry Hub. During the winter months, New England lacks sufficient natural gas capacity and, therefore, basis prices (the cost to deliver gas via the interstate pipeline or external LNG sources) are the highest they have been in history, which causes spot prices to skyrocket as weather becomes colder. We have been monitoring spot price (the daily market price) and temperature since December 1 and we are seeing the obvious relationship between temperature and spot prices. On December 13 and 14, spot prices in New England reached $20, which by the way, is around the same price as oil and on those days, the average temperature in Boston and Hartford dropped below 30 degrees. This is consistent with all predictions and what the industry is projecting.

What should businesses do, think about, and plan for in the new year?

Businesses should plan for the increase based on what we are seeing for pricing today. In other words, make decisions with the information on hand today. Begin to plan now for years in the future. Knowing your cost baseline and monitoring price over time will allow businesses and consumers to make decisions. Some consumers may choose to lock their price for the future. For those customers, our recommendation is to lock some or all of your future needs for the next couple of years when a dip in the market occurs. Time in the market is the best way to time the market, as it relates to fixed price strategies.

With respect to European pricing, where is it trending and what will the impact be on New England?

As you can see from the graph below, the market climbed to epic levels in the summer of 2022, based on uncertainty around world energy flows and how Europe would replace oil and gas previously supplied by Russia. Since that peak, the picture has become clearer. Europe has beefed up its LNG import capacity and supply, agreements have been reached between Europe and Asian buyers and LNG suppliers. Weather has cooperated, and Europe has reinforced its natural gas inventory levels. On January 2, 2023, the Dutch TTF price fell to the lowest level since before the Russian invasion of Ukraine.

Figure 1: Bloomberg Dutch TTF

Bottom Line

It isn’t too early to start planning for winter 2023-24. I recommend that businesses pay attention to what happens to daily spot prices, prepare your facility, set a baseline using current market price, and continue to monitor the market looking for realistic price triggers if fixed price is a component of the overall commodity strategy. That will help you better manage your energy usage and spend next year. Now is the time to pay attention to the market and plan for winter 2023/2024.

At the end of the day, businesses should consider seeking objective advice. It is as simple as that. Energy markets and weather in particular can be unpredictable. Competitive Energy Services’ guidance and perspective has been tried and true for almost 23 years now. Simply put, CES enables clients to achieve their energy and sustainability goals. This has been our purpose and our reason for being in business all of these years. If you are unclear or unsure about your particular energy needs, reach out to one of our CES Energy Services Advisors to discuss your company’s energy strategy, position, and options. CES continuously provides a pragmatic approach to help current and future customers navigate difficult times.